will capital gains tax increase in 2021 be retroactive

June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a.

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Bidens Proposed Retroactive Capital Gains Tax Increase 2 weeks ago Jun 14 2021 Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital.

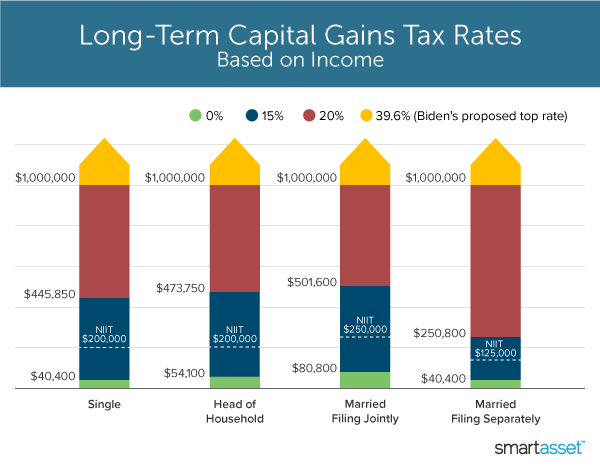

. Much research has been done on the optimal rate of capital gains tax to maximize the tax revenue. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million. He would also change the tax rules for.

07 2022 GLOBE NEWSWIRE. President Joe Bidens proposal to raise the capital-gains tax rate to 396 from 20 for those earning 1 million or more was first announced April 28 as part of the. The only major capital gains rate increase since 1980 was not made retroactive.

The purpose of President Bidens. This is a total of 1124000. The higher the rate the less likely taxpayers will sell assets and be subject to.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396. Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023.

Will capital gains go up. Having resolved the infrastructure bill Congress now begins debate and. CALGARY Alberta Nov.

Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds.

Heres how financial advisors are responding. This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a higher. So what happens this time.

President Joe Biden is calling for a 396 top capital gains tax rate retroactive to the date of announcement. Signed 5 August 1997. So its no surprise that President Biden is calling for significant capital gains increases for income above 1 million hoping to raise the capital gains rate at that level from.

The increase in revenue would come from the higher tax brackets thus forcing high-income taxpayers to shoulder additional tax liability. Effect of Capital Gains Tax.

Are Taxes Going Up Mission Wealth

Steps Advisors Could Take Ahead Of Potential Changes In Capital Gains Tax Law Aperio

Will You Be Paying Higher Taxes On Your Capital Gains Elderado Financial

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Since 1954 Capital Gains Tax Policy Hasn T Driven Markets Defiant Capital Group

Crystal Ball Gazing To The Past Article By Pearson Co

Biden Plans Retroactive Hike In Capital Gains Taxes So It May Be Already Too Late For Investors To Avoid It Report Marketwatch

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

What S In Biden S Capital Gains Tax Plan Smartasset

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Lawmakers Push For Retroactive Tax Increase Nam

Will Tax Changes Sink The Market Creative Planning

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Be Ready For Big Changes 2021 Tax Planning

Advisers Blast Biden S Retroactive Capital Gains Proposal

Biden Budget Calls For Retroactive Capital Gains Tax Hike Thinkadvisor

2022 Capital Gains Tax Rates Federal And State The Motley Fool

75 Of Stock Owners Won T Pay Biden S Proposed Capital Gains Tax Hike